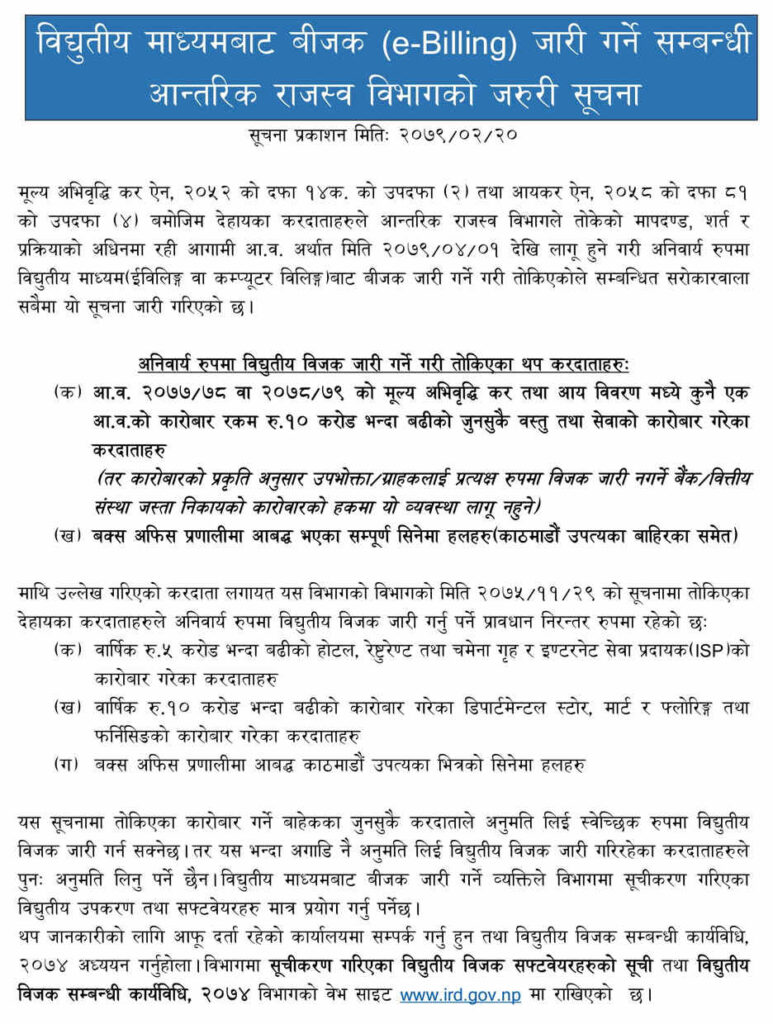

A notice issued by the Inland Revenue Department mandates the issuance of e-billing for selected companies from Shrawan 1, 2079. E-bills must be issued by companies with annual transactions or revenues of more than Rs 10 crore.

A fine of up to Rs 5 lakhs will be imposed on them if they do not comply. The following article is aimed at companies and individuals with an annual turnover over Rs 10 crores.

A new rule also helps direct VAT scrutiny of more companies and encourages them to move towards digital technology as part of the Digital Nepal Framework.

Confused about the e-Billing system?

E-Billing or Computer Billing Systems are IRD Approved Accounting Software that generates, prints, and issues Tax Invoices. Electronically maintaining Sales and Purchase Registers is also possible with the system. If manual invoices are sent via paper or pad, you need not keep a manual sales/purchase register.

It is also capable of sending or syncing invoice records to the IRD central billing monitoring system whenever required by the Tax Office.

There are many advantages to e-billing, including:

- More transparent record keeping than paper bills.

- Faster payment and notification of payment status when integrated with online payment system.

- No hassle of keeping paper records for long period of time as you can keep electronic records.

- Simplified bookkeeping and accounting when used with full featured accounting system with electronic billing feature.

- Clean and Clear bills to the customer without handwritten mistakes

Online Vat Billing Software – Easy Bill Plus

Pioneer IT is an Authorized partner of Tally accounting software, we can deal with computerized billing software easy bill plus which is verified by IRD.

Easy Bill Plus is a product designed specifically for computerized billing. A variety of billing and customized report features are included in the software. Inland Revenue Office’s latest circulated notice specifies the mandatory mechanisms for data entry, related statutory requirements, and reports.

There are a variety of business verticals that can be managed with it, such as Educational Institutions, Trading Houses, Restaurants, Medical Distribution companies, Advertising Agencies, Travel Agencies, Vehicle Dealerships, and many others. The billing formats and custom reports can be customized based on business requirements.

Features of Easy Bill Plus

- Invoices

- Order Fulfillment

- Dunning Notices

- Recurring Invoices

- Credits

- Items and Services

- Time Tracking

- Project Management

- Tasks

- Individual Stationery

- Employees and Roles

- Tax advisor

- Security

- Shipping

- DATEV-Datenservice

- Bank reconciliation

- Cloud Backup

1 thought on “Buy Online Vat Billing System in Nepal”